Everything You Need to Know about a Voyage HELOC Loan

What is HELOC Loan?

HELOC loans are also known as other terms such as HELOC, home equity, home loans, mortgages, and second mortgages. In this podcast, we are talking in specific about Voyage’s HELOC options, which is our home equity line of credit.

This HELOC loan is a variable product. It is similar to an open-ended revolving credit line that you can use and it uses your mortgage as collateral. Most of the time the loan is in a second position. Meaning this would be an additional loan to your current mortgage that you have. Some people who have paid off houses can do the first position for a home equity line of credit too.

The loan is designed to be used for anything that life can send your way. The money is accessible at any time. Once you go through the application process and get approved, we set up a line of credit for whatever dollar amount we can do for you. Then the money is accessible to you whenever you need it.

What’s the difference between HELOC and a home equity loan?

We have home equity loans at Voyage as well. A home equity loan would be more like your standard closed-in loan. We do a loan for you using your home as collateral, but using the loan for a specific process or a specific item. We fund the whole loan and give all the funds to you. You then start your normal repayment schedule.

Voyage has a five-year, seven-year, and 10-year repayment structure. Those are more set if you know exactly when you need the funds, and how you’re going to use the funds. The home equity loans also tend to be a little safer possibly just because those are fixed rates. The rate that you close the loan at is what your rate stays the whole time with a home equity line of credit.

HELOC loan is a variable rate according to prime. The pros are that you can access those funds when needed. However, the cons can be that if the prime rate changes up or down, your rate would change along with it so that it’s not rate-protected that way.

How much can you borrow on a HELOC Loan?

The equity line of credits can go to a max of 90% loan to value. 90% loan to value means we establish your value through an appraisal. We take that number times 90%, and then we minus out any other mortgages that you owe such as your current first mortgage. If you’re in the first position or if you don’t have a mortgage, then you can borrow quite a bit more.

Basically, we take that times 90%. We might have sought your first mortgage and then the remaining amount is the lendable equity. Therefore, depending on how much you have to get to that 90%, it would be the first thing that you can borrow. And then the second piece of that would be what we can qualify you for.

We have to make sure that your debt to income ratio, your credits, and all other underwriting standards that Voyage has in the policy are in line.

What do you use a HELOC for?

You can use the HELOC loans for anything. We get an initial purpose of what the loan is intended to be because it’s the loan that we are extending funds for, but we don’t regulate it. If you call and request $15,000 tomorrow, we will just advance that Voyage account for you and you’re ready to go. Thus, the loans can be used for college or for buying an auto instead of doing an auto loan. Home improvements are obviously a common purpose. In addition, a lot of people are probably putting the money into pools, fun activities.

You can just have that funds accessible, and then you can pay down that balance and re-utilize those funds again if that timing lines up. That’s why it’s structured as open-ended. You can use that line of credit however you want: you can apply for payments and then you can use more. It’s just kind of that revolving however those funds are needed to be used for your personal life. It’s time to go on a vacation or do something fun post-COVID.

How am I eligible for HELOC?

For Voyage, to offer you a HELOC, you just have to be able to be a Voyage Member or be able to qualify for being a Voyage member, which is limited to Lincoln or Minnehaha County. We need you to live, work or worship in Lincoln or Minnehaha to establish that membership. And by membership, we just mean open to having at least a savings account with us. Then it would just go through the pre-approval process to get an application, the list of items that we need to look at the pre-approval and make sure that the collateral is sufficient. We will then process the request and tell you how much you qualify for.

How do I apply for a HELOC Loan?

We have a great online mortgage application at voyagefcu.org. There is a navigation bar on the top and under loans, you can apply to purchase refinance, home equity, construction, whichever that you’re exploring. You can click on that and it’ll take you right through our online application.

What do I need to complete my HELOC application?

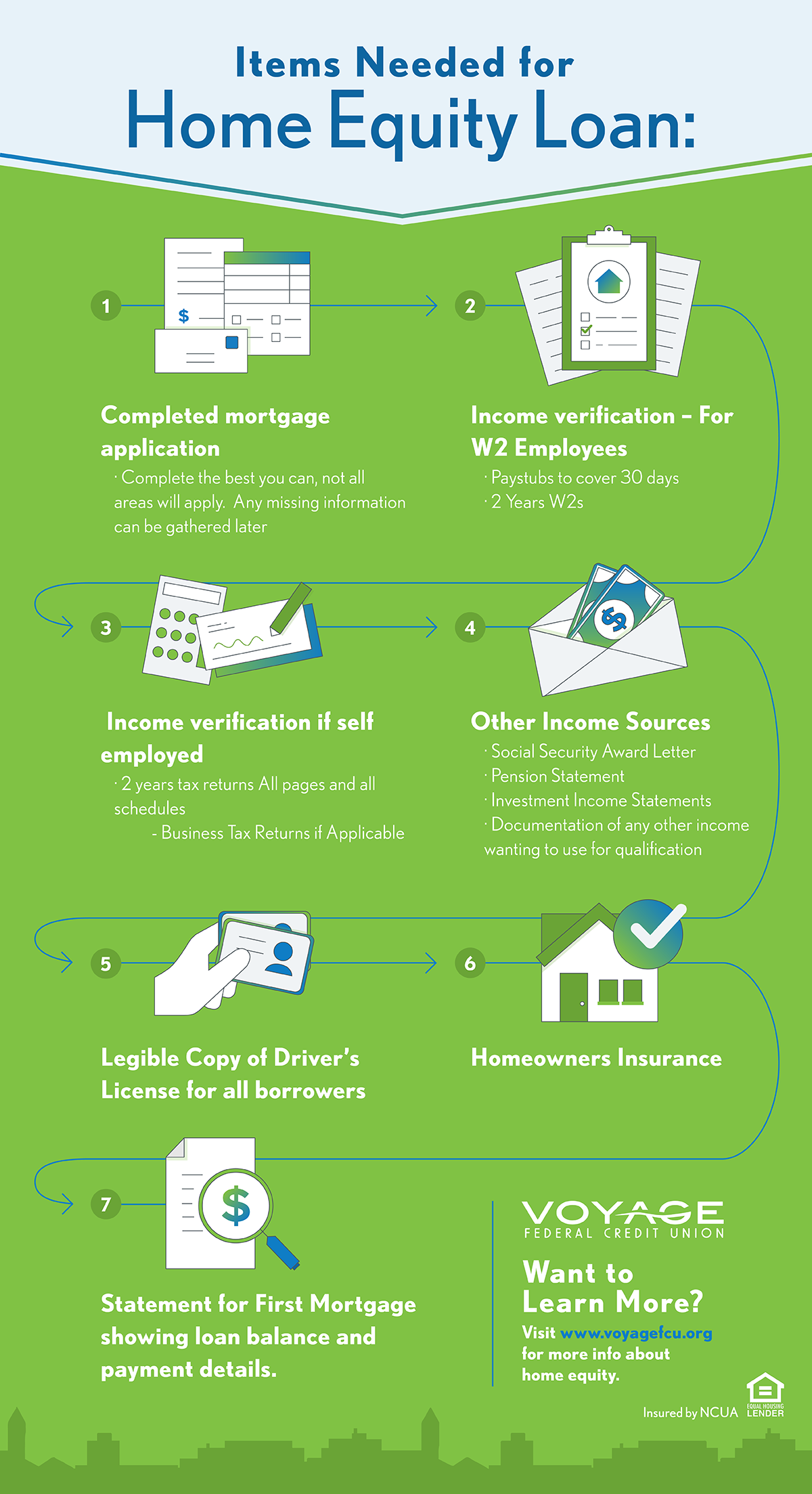

You can complete the application online or in-office at one of our locations with one of the loan officers We have three loan officers including myself that are able to help you at any time. We sit down and help complete the HELOC application. But if you do the online application, here is what we would need:

Proof of income:

If you are W2:

Last two year’s W2.

Last month’s worth of pay stubs.

If you’re self-employed:

Last two years tax returns, business and personal, depending on how you file.

Miscellaneous:

Homeowners insurance (to make sure you’re helping your home is insured).

Driver’s license (to verify identity)

If you’re on any other kind of income like social security disability.

Employer information to verify and document it.

On both our website and in our branches, we have a nice little infographic that walks you through the online application.

How much time will I have to repay the HELOC loan?

Our home equity line of credit is set up on a 15-year term. You have a five-year drop period to use those funds that we’ve set for that line of credit. You can draw a repay, drop repay, however you want to use those funds in that five years. During that time all we require is interest since your balance is fluctuating on how much you’re advancing or drawing. Your payment amount changes because your balance may fluctuate quite a bit from month to month, depending on how you’re using it. So we calculate it based on a daily interest, and that interest is due monthly.

After that five years, if you still have a balance on your line of credit, it doesn’t balloon. You don’t have to pay it all off, but it will get reset into a 10-year repayment schedule. Within that 10 years, it is calculated. The payments will change to be a full principal and interest and calculated to pay off the loan in that 10 years. It does stay variable that whole time as well. It is not fixed at all ever.

Could you refinance it to a fixed one?

Absolutely. Any time throughout the process of the five-year drop period or the ten-year repay you can refinance. Whether it is a first mortgage or purchase or refinance a home equity construction, none of them have repayment penalties at Voyage. You’re welcome to pay them off, sell the house, whatever you want to do, and you can do that at any time.

What happens if I sell my house when I have a HELOC balance?

We just treat it as another payoff. It’ll basically be just net out of your gross proceeds of what you would have from selling your house. A lot of times you have the first mortgage you’re paying off if you sell a house, now there’ll be a new second mortgage home equity. They all mean the same thing. They’re just all slang terms for having another payoff. It will reduce the amount that’s actually coming to you at closing. You have already utilized some of your equity and used it in your benefit to loan against it and use it throughout the process of owning a home to benefit yourself.

Can you talk about the HELOC Promotion Voyage is running?

We are doing a HELOC promotion at a 1.99% interest rate for six months. This would be six months starting when the loan originates. When you draw, if you do a loan in May, you have six months from that time period of when that loan was made for us for that 1.99% Introductory Rate. Now is the time to be doing all the fun things that you’re delaying or not wanting to do because we have a great interest rate for you.

Our HELOC promotion runs from May through August. So get in sometime this summer and get your HELOC. The loan doesn’t have to be closed by end of August. We just have to have applications in so if we need an appraisal or something else, the loans might take some time. The average timeframe is two to four weeks on these. We’re not going to require the loans to be closed by the end of August, but we do need applications by the end of August.

Whenever that loan is originated and the loan is made and the line of credit is opened up, that is when that 1.99% triggers. We do have some closing costs. An appraisal may or may not be needed. We can draw that from a line of credit, so you don’t have to drain any cash if you don’t want to. We can definitely work some various options for you.

Make sure to stop into one of our Voyage locations and chat with one of our mortgage officers. We’ll give you all the final details to get in on this 1.99% rate.