What’s All the Fuss About Online Banking?

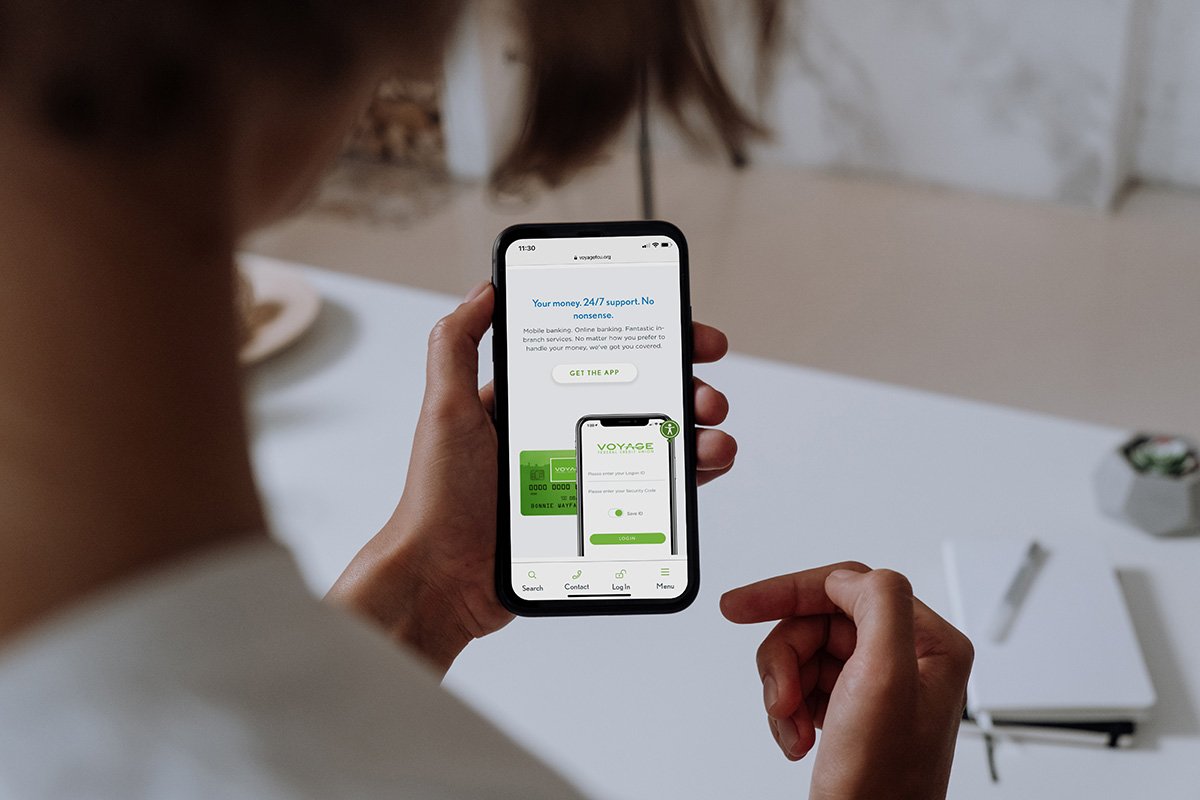

How can online banking make my life easier?

The biggest thing is the convenience factor. When I first started at the credit union, 19 years ago, if you had banking to do, you had to get to the branch, on a certain day of the week, a certain time frame, otherwise, you just weren’t going to get it done. Everyone has busy schedules these days. With online banking, you can bank whenever you need to. I think that has made everyone’s life easier. Also, just because we don’t have a branch in the town where they’re living currently doesn’t mean they can’t bank anymore.

Are finances and privacy safe with online banking?

Absolutely. I think that’s one of the biggest hindrances to some members who may be wanting to use online banking but are afraid of the safety risks. There are some things our members can do to mitigate potential risks though. One is to make sure you’re accessing online banking from a safe and secure network. Another way of mitigating risk is to set strong login IDs and passwords when you enroll. Additionally, if you log in from a different IP address, it recognizes that and asks you to answer some security questions that you set up when you enrolled.

You can view your monthly statement online too. The e-statement is almost a safer way of receiving your statement. If you think about it, your paper statement can get lost in the mail, and then your account number and information is floating out there. If it does get to your mailbox, oftentimes it sits in an unlocked mailbox. Especially this time of year, we see a lot of videos of people stealing packages or going through mailboxes.

How does mobile deposit work?

The first requirement is to have a checking account with us. The mobile deposit obviously only works with our app. At the bottom of the app, there’s a deposit option feature. When you click on that, you can choose which checking account you’d like the check to go into. Then you enter the amount of the check. Once you do that, it’ll activate the camera and you’ll take a picture of the front of the check. You can retake the image until you’re satisfied or you can select to use it. Then you turn the check over and do the same thing.

The next option is to make the deposit. There are some timing aspects with that. If you make that deposit by 3:45 p.m. it will be deposited by 5:30 p.m. that business day. If it’s after 3:45 p.m. it’ll be deposited on the next business day. So try and get it in a little earlier in the day and get those funds available the same day.

How does bill pay work?

You can use bill pay through online banking or the mobile app. Online, there’s a bill payment tab you click on. The next step is to add your payees like utility companies, cell phone payments, loans, and other financials. When you’re going through the setup process, you should have the stub for your bill because it’s going to ask you for items like the account number. Once you get the payees entered, then you can determine if it’s a recurring payment and when you want the payment to be sent. Most of these bill pays are effective the next day.

What types of accounts can I access with Voyage’s online banking?

You can access all of your accounts. Any deposit account, loan account, even your credit card can be accessed. You can also access joint accounts with your kids. We can link those to your primary login account so that you can see those and transfer money back and forth.

How do I get started?

To enroll you’ll use a web browser and need two pieces of information: your member number and a four-digit PIN. The four-digit PIN is not your debit card or ATM pin, it’s going to be the PIN for your phone banking that we set up when you get your new account. If you’re not sure what that is, you can certainly give us a call and we can reset that for you. Then you enter your login ID and password. The next step is to answer some security questions. After that, you can access your account. So it’s a pretty easy enrollment process.

Let us help you set up online banking today. You’ll have the same great service with the convenience to bank anywhere, any time. Enroll online, or give us a call at 605.338.2533.