Understanding Auto Loans with Credit Unions

Understanding auto loans through credit unions can simplify buying or refinancing a vehicle. This guide provides clear insights into securing financing, managing car loans, and leveraging credit union advantages. Whether you're purchasing your first car or looking to refinance an existing loan, the right knowledge can make all the difference.

You'll learn the essentials of auto loans provided by credit unions, including how to apply for a loan, get pre-approved, and use auto loan calculators effectively. You'll also discover the best practices for refinancing car loans and selling a car under a loan agreement. This information will equip you with the tools to make informed decisions on financing your vehicle through a credit union.

How Do Auto Loans Work?

Car loans from credit unions offer competitive rates and flexible terms. Understanding the basics—like interest rates, loan terms, and monthly payment calculations—is the first step. Credit unions often provide more personalized services, which can lead to better loan conditions for their members.

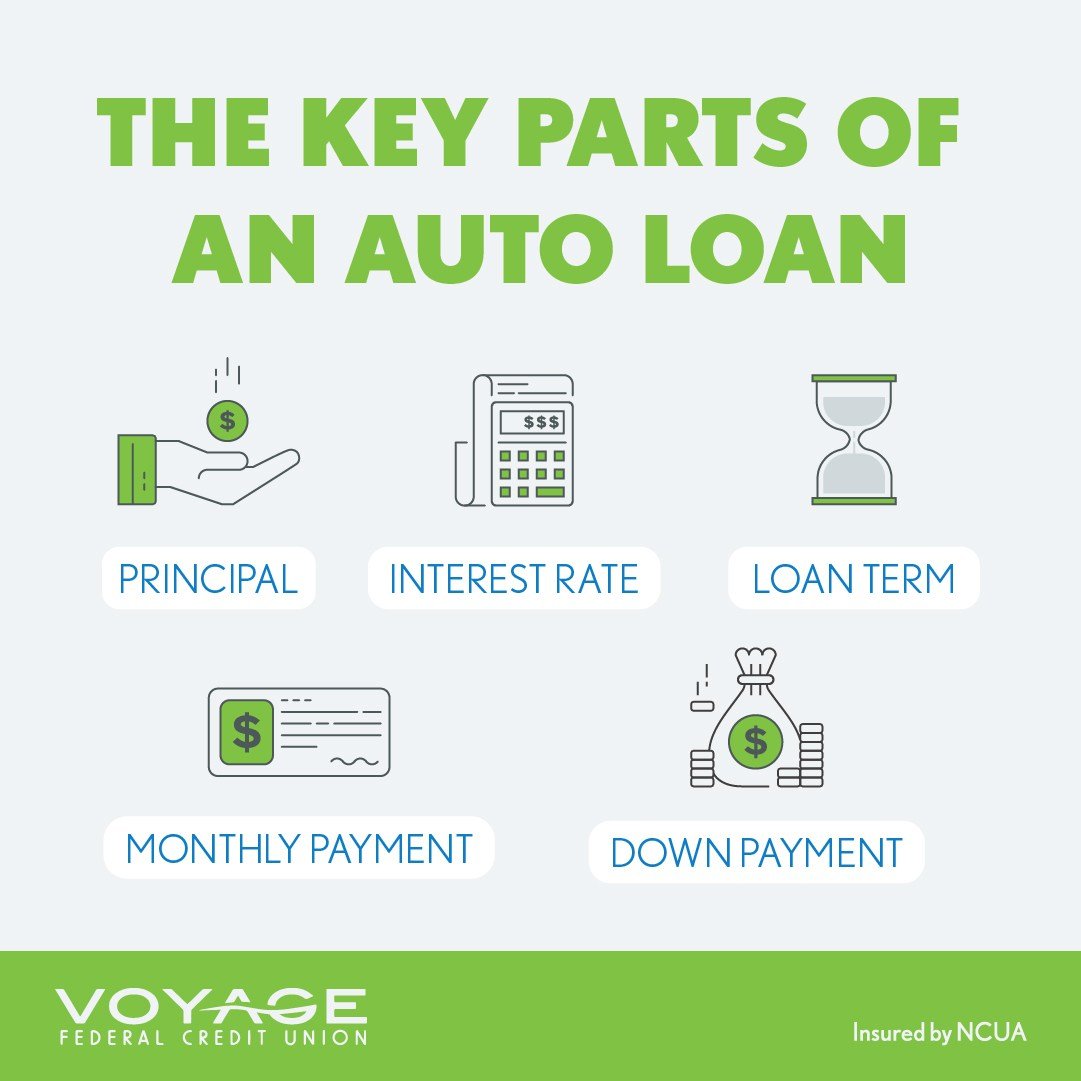

When you take out an auto loan, you borrow money from a lender to buy a vehicle. In return, you agree to pay back the loan plus interest through monthly payments. Here are the key parts of an auto loan:

Principal: The amount of money you borrow to buy the car.

Interest Rate: The percentage charged for borrowing the money. Credit unions often offer lower rates than banks.

Loan Term: The length of time you have to repay the loan, usually between 24 and 84 months.

Monthly Payment: The amount you pay each month, which covers both the principal and interest.

Down Payment: This is the money you pay upfront when buying the vehicle. A larger down payment can reduce your loan amount and monthly payments.

Credit unions may also provide additional benefits like fewer fees and flexible payment options. They often consider your overall financial situation, which can help if you have a lower credit score. Comparing loan offers can help you find the best terms for your needs.

How to Get Pre-approved for an Auto Loan

Getting pre-approved for an auto loan involves checking your credit score, gathering necessary documentation, and understanding your budget. An auto loan pre-approval can give you a clear idea of what you can afford and puts you in a stronger position when negotiating the price of a vehicle.

How to Apply for an Auto Loan

Applying for an auto loan requires you to submit personal and financial information to assess your creditworthiness. Applying for an auto loan can affect your credit score.

Credit unions may offer the advantage of lower interest rates compared to traditional banks. Ensure all your documents are in order to streamline the approval process. It's also important to understand the auto loan terms in your pre-approval.

Using an Auto Loan Calculator

A car loan calculator is a useful tool that helps you estimate monthly payments, total interest, and loan terms. By adjusting the purchase price, down payment, loan term, and interest rate, you can plan your finances and choose the best loan offer for you.

Try our auto loan calculator to get started on planning your next car purchase.

How to Refinance an Auto Loan

Refinancing your car loan with a credit union can lower your interest rate, decrease monthly payments, or adjust the loan term. Here are the steps and considerations for refinancing:

Assess Your Current Loan: Review your current loan terms, including the interest rate, monthly payments, and remaining balance.

Check for Penalties: Some loans have prepayment penalties. Ensure your current loan doesn't charge extra fees for paying it off early.

Calculate Savings: Use a car loan calculator to see how much you can save by refinancing. Consider the new interest rate and how it affects your monthly payments and total interest paid.

Apply for Refinancing: Gather necessary documents like your current loan details, proof of income, and credit report when submitting your application to Voyage Federal Credit Union.

Avoid Refinancing If:

There are High Prepayment Penalties

Remaining Loan Term is Short

Risk of Potential for Higher Interest Costs

Refinance If:

Improved Your Credit Score

Need Lower Monthly Payments

Refinancing can be a smart financial move, but it’s important to weigh the pros and cons carefully. If you’re considering refinancing your auto loan, contact Voyage to explore your options and find the best solution for your needs.

How to Sell a Car with a Loan

Selling a car with an outstanding loan requires you to understand the payoff amount and manage the transaction so that the loan is cleared upon sale. Transparency with buyers about the loan and possibly using credit union services to manage the transaction can simplify the process.

Selling a car with an outstanding loan involves a few key steps:

Ask what the Payoff Amount is: Contact your lender to find out how much you need to pay off the loan.

Check Your Car’s Value: Use online tools to see your car's current market value.

Inform Potential Buyers: Let buyers know about the loan and how it will be handled.

Once you’re ready for the sale, there are two different ways to handle it. If it’s a private sale, meet at your lender’s office, where the buyer pays the lender directly to clear the loan. If it’s a dealership sale, the dealership handles the payoff and paperwork for you. Once the paperwork is done, you want to make sure the title is transferred to the new owner after the loan is paid off.

For a smoother process, contact Voyage for assistance and expert guidance.

Credit unions are a viable and often beneficial option for financing cars, whether you're buying new, used, or refinancing. With favorable terms and member-focused services, they can offer significant advantages over traditional financing routes.

If you’re considering an credit union auto loan or want to explore more about your options, reach out to Voyage for tailored advice and competitive loan offers.